The total tax amount for your $75,000 income is the sum of $1,027.50 + $3,780 + $7,309.50 = $12,117 (ignoring any itemized or standard deduction applied to your taxes).But some of your income will be taxed in lower tax brackets: 10% and 12%.Īs slices of you income move up the ladder, they’re taxed at increasing rates: Let’s say you’re single and your 2022 taxable income was $75,000 your marginal tax rate is 22%. Use our federal income tax bracket calculator below to find your marginal tax percentage for the 2022-2023 or 2023-2024 tax years. This bracket is your highest tax rate–which applies to the top portion of your income. The tax bracket your top dollar of income falls into is your marginal tax bracket. The bracket you’re in depends on your filing status: if you’re a single filer, married filing jointly, married filing separately or head of household. You can calculate your taxes by dividing your income into the portions that will be taxed in each applicable bracket.

#CURRENT MARGINAL TAX RATE HOW TO#

How To Calculate Your Federal Income Tax Bracket Here are some reasons why you should file. You may be entitled to money from the IRS even if you have little to no income. Trending Story: File A Tax Return This Year, Even If You Usually Don’t Do It Some of that will be taxed in lower brackets. For example, if you’re single and your 2022 taxable income was $50,000, not all of that will be taxed at 22%, the top bracket for a single person making $50,000. If your taxable income increases, the taxes you pay will increase.īut figuring out your tax obligation isn’t as easy as comparing your salary to the brackets shown above. The amount you pay in taxes is dependent on your income.

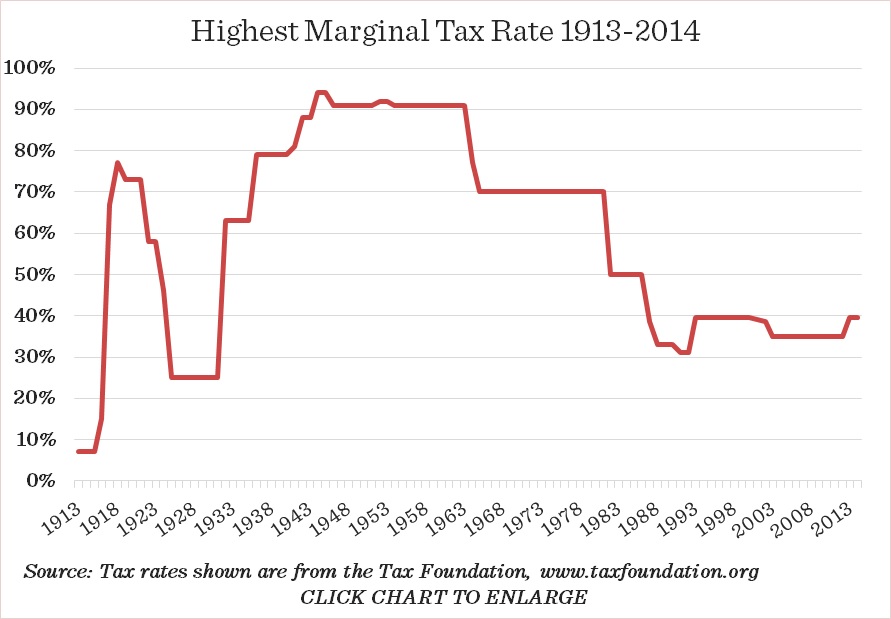

The brackets help determine how much money you need to pay the IRS annually. Tax brackets were created by the IRS to implement America’s “progressive” tax system, which taxes higher levels of income at the progressively higher rates we mentioned earlier. The effective marginal tax rate for individuals is the percentage of an additional dollar of earnings that is unavailable because it is paid in taxes or offset by reduced benefits from government programs. For a corporation, the effective marginal tax rate is its tax burden on returns from a marginal investment (one that is expected to earn just enough, after taxes, to attract investors). Another measure-the effective marginal tax rate on capital income-is broader than the effective marginal corporate tax rate, because it also accounts for the taxes paid by individuals on interest, dividends, capital gains, and the profits of businesses not subject to the corporate income tax.2023 Married Filing Jointly Tax Brackets If taxable income is: For corporations, the average tax rate is calculated by dividing corporate tax liability by before-tax profits.ĬBO’s measures of effective tax rates, however, vary by type of tax unit and form of income. For individuals, CBO computes the average tax rate by dividing individual tax liability by before-tax income. The measure of average tax rates is similar for individuals and corporations. CBO periodically analyzes two alternative measures of tax rates that are affected by many of those provisions: the average tax rate and the effective marginal tax rate.

Other provisions in the tax code-including tax preferences and surtaxes-also affect taxpayers’ decisions and the distribution of taxes. The statutory tax rate structure, which is set by law, is one of the many features of the tax system that influence taxpayers’ behavior and that also contribute to the distribution of tax burdens across households.

0 kommentar(er)

0 kommentar(er)